Car depreciation calculator tax deduction

All you need to do is. Fewer than nine passengers.

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Tax

Total expenses for the truck 7000.

. In February 2019 the IRS published a revenue procedure that provides a safe harbor method of accounting for determining depreciation. Discover Helpful Information And Resources On Taxes From AARP. It can be used for the 201314 to 202122 income years.

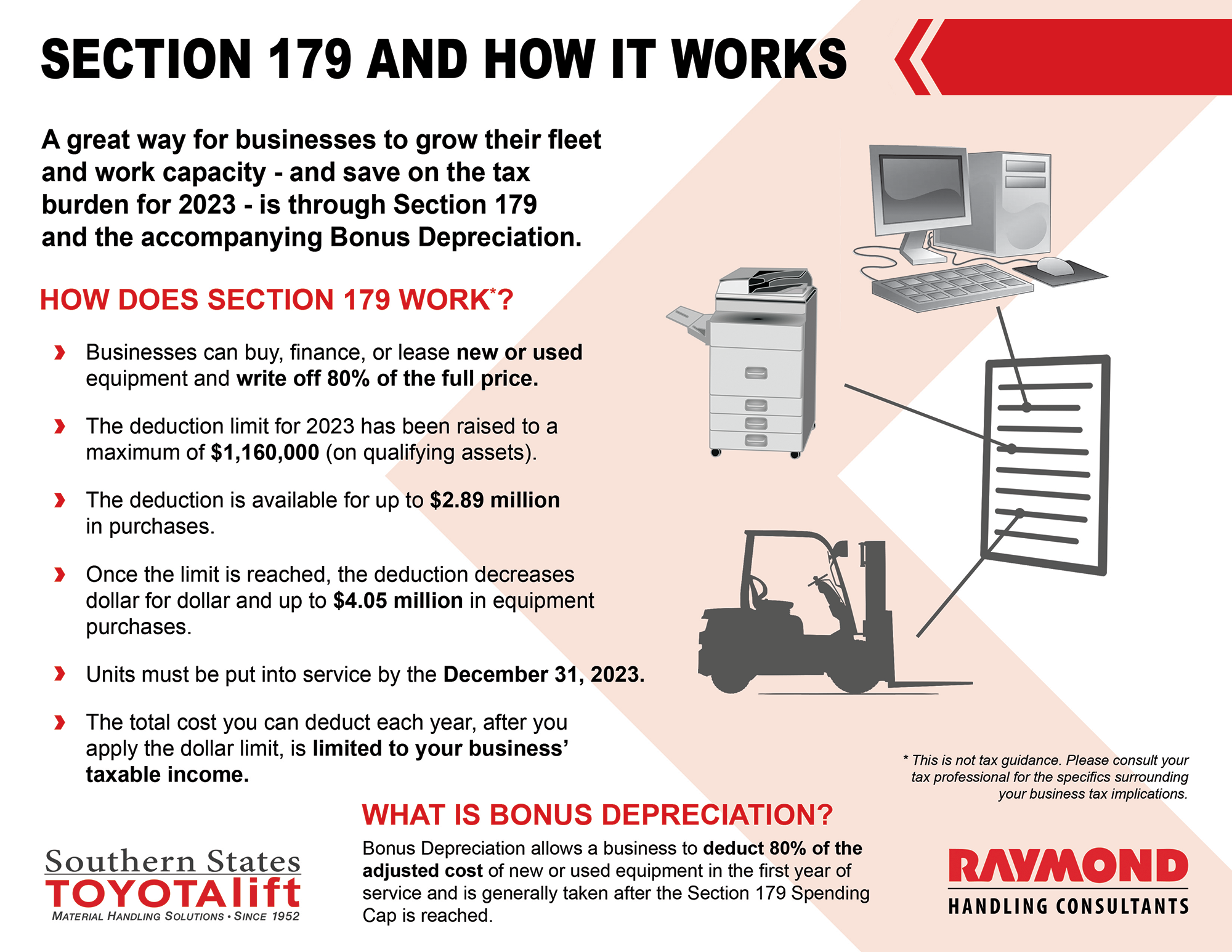

Most calculators use data including. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the.

The 2022 standard mileage rate is 585 cents per mile and for 2021 is 56 cents per mile for business. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Licence and registration fees 100.

Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Section 179 deduction dollar limits.

Nine passengers or more such as a. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. Cars for income tax purposes are defined as motor vehicles including four-wheel drives designed to carry both.

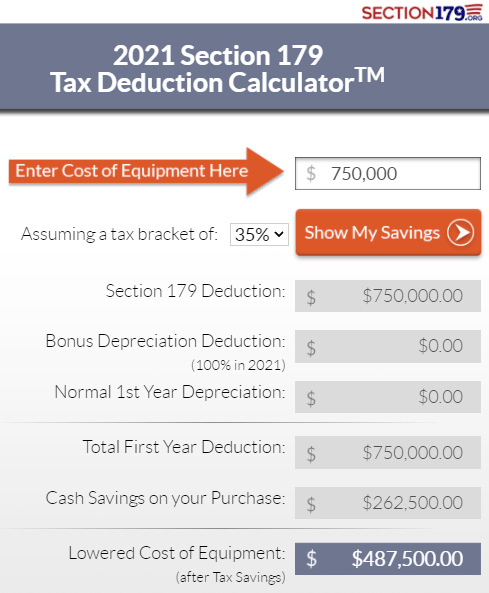

We offer like-new well-maintained vehicles for all types of shoppers. Example Calculation Using the Section 179 Calculator. Select the currency from the drop-down list optional Enter the.

The calculator also estimates the first year and the total vehicle depreciation. Murray calculates the expenses he can deduct for his truck for the tax year. Alternatively if you use the actual cost method you may take deductions for.

A vehicle expense calculator helps you calculate the amount you can claim as a tax deduction for work-related car expenses for eligible vehicles. We will even custom tailor the results based upon just a few of. You can claim a maximum of 5000 business kilometres per car.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. 510 Business Use of Car. Ad Deductions for Healthcare Mortgage Interest Charitable Contributions Taxes More.

66 cents per kilometre for the 201718 201617 and 201516. This limit is reduced by the amount by which the cost of. To calculate your deduction multiply the number of.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. This is a slight increase from the 2021 Section 179 tax deduction. Depreciation of most cars based on ATO estimates of useful life is.

Interest on loan to buy truck 1900. Get Your Maximum Tax Refund. The deduction limit in 2021 is 1050000.

Ad Let us help find you the perfect first car for the new driver in the family. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. But while Bonus Depreciation isnt technically part of Section 179 it can often be used as Part 2 of Section 179 savings.

If youre in the market for a brand new car maybe youre using that tax refund to take care of the down. For example lets say you spent 20000 on a new car for your business in June 2021. Learn How Much A New Car Depreciates How to Calculate Depreciation.

A special note about automobile depreciation. It is fairly simple to use. You use the car for business purposes.

Bellamy Strickland Commercial Truck Section 179 Deduction

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Macrs Depreciation Calculator With Formula Nerd Counter

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate Marketing

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

Real Estate Lead Tracking Spreadsheet

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Section 179 Deduction Hondru Ford Of Manheim

Free Macrs Depreciation Calculator For Excel

Irs Updates Auto Depreciation Limits For 2020

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

The Current State Of The Section 179 Tax Deduction